Great News: It’s Possible to Successfully Downsize Your Life And Benefit Financially, While Simultaneously Launching a Great, New Lifestyle

By Anne L. Holmes, NABBW’s Boomer in Chief

Periodically, as we Boomers age through the various stages of our lives, there come times when we face a major crossroad and we have to make huge, life-altering decisions. These days, instead of those decisions being related to school, work, marriage or the birth of our children or grandchildren, many of our crossroads experiences begin with the letter “D.” As in “Disease,” “Divorce,” “Death” — and that other one, much less less serious, but still daunting — “Downsizing.” Today, we’re going to talk a bit about downsizing – and hopefully remove any concerns or worries you might have with the concept.

The first time my husband and I took the downsizing plunge, our youngest child had just graduated from college. Yes, our kids had asked us to please hold on to the 5-bedroom, 4-bath family homestead — and all of the personal belongings they hadn’t already taken with them — while they were still in college. And we not only agreed, we kept our promise.

But within a month of the youngest receiving his BA, we “flew the coop” — welcomed a moving van and crew to our front door, and headed out-of-state to an interim home. That is, we started the process by moving into a very cool but temporary apartment located in an historic building in our new community. Our selected destination: a small town where we had once owned a vacation home. We wanted this historic community to become our next hometown, but at that point, we hadn’t yet decided whether we would buy a preexisting home or build. Thus, a temporary rental apartment seemed to be our best option.

Our reason for making an interim housing decision was solid and based on familial experience. About a decade earlier, my mother and stepfather moved from the Upper Midwest to the deep Southwest and had built their new home before moving. We learned from their experience that it is a very smart idea to be living close to the community where your new home is being built, so you can handily and regularly oversee all the myriad decisions — both large and minuscule — that have to be made during construction. Why? To stave off any need for rework, should there be any miscommunication between you and the builder.

Speaking of decisions, I can’t begin to explain all the steps we needed to make before successfully downsizing into that temporary apartment. But let’s just say that our first hurdle was to figure out how to get rid of the tons (literally) of “stuff” we’d been living with. You know what I mean: the furniture, furnishings and detritus of life we’d acquired over our twenty-some years of married life. Things we had once cared about, but really didn’t need anymore.

Here’s how we divested ourselves in advance of our downsize:

-

I don’t like the prep work involved with garage sales, but the payoff from a well-executed one can be significant.

Initially we invited a handful of nieces who were of the age where they were just coming into adulthood to come to our home in order to check out all the furnishings we knew we were not keeping. We happily gave them cart blanche to haul off any furniture and furnishings we had moved to our garage because we knew they would be unnecessary in our new digs. And thankfully, our nieces proved to be “happy haulers.”

- Next we orchestrated several home visits by entities like Goodwill Industries and the Salvation Army. Organizations which accept donations and were happy to haul away the rest of our excess furniture.

- After that, we ran a hugely successful garage sale,

- Made dozens of book donations to our local library,

- Contracted with a guy whose business was selling stuff on e-Bay. Once he sold a myriad of trash bags full of stuff like video tapes and the like on our behalf, we split the proceeds with him…

- And finally, we employed a company whose business it was to cart off all the junk we deemed not worth keeping.

- About the only thing we didn’t try was an estate sale, but more about that in a bit.

If you are considering downsizing, YOUR pre-move steps may not be the same as the ones I listed above, but here’s a link to a great article from BudgetDumpster.com which covers the basics of how to reduce how much you end up moving when you make the transition to your new smaller, home.

While the above story happened almost twenty years ago, my husband and I are are now in the early stages of determining whether or not we will downsize once again within in the next couple of years. This time, the downsizing will not be due to a reduction in “nest size.” Though like our earlier experience, this experience would still be an out-of-state move, though this time we’ll be transitioning to an “aging in place” sort of older adult community back in my home town. If we decide to do this, we and my siblings would all be moving to the same older adult neighborhood, which is located in our home town.

Because we’re all still very active and independent adults, the plan is that we will all start out living independently in our own homes. But during the twenty or so years we expect we will live there, we are comfortable knowing that we will have an easy option to move to assisted living, and if necessary, step down again to a nursing home or memory care facility as our health needs dictate.

What we really like is that all of these facilities are located on the same multi-acre campus, so the transitions, as we need to make them, will be smooth but our entry into whatever facilities we need is guaranteed. This downsize move is another big decision, and while we are in the process of getting ourselves on the waiting list, we don’t anticipate we will actually sell our current homes and make the initial move for a at least a couple of years.

Nevertheless, it is pretty exciting. And I’m happy to know that having downsized once, I can do it again.

However, before it is time for us to make that next downsizing move, I am quite sure my husband and I will first work with a local contractor to hold an estate sale. The reason: I have already consulted with all of my adult kids and know that they have absolutely no interest in owning any of the awesome “stuff” I still held onto after our initial downsizing experience. I am totally clear that the things — like the crystal and fine china which were once wedding gifts — and which I am currently storing in my basement because I have no need for them these days — are of absolutely no interest to my children. And I have no interest in saddling them with the need to figure out what to do with these former treasures after we die.

So I figure we’ll hold a “we’re still alive and kicking” estate sale and sell off those treasures now — which means we’ll once again have a lot less stuff to move — while simultaneously benefitting financially by personally pocketing the sale proceeds rather than leaving this step to our kids have to handle after we’re dead. Plus, we’ll again get to experience how freeing it feels to downsize ourselves out of no-longer-needed belongings.

SO: If you are also considering downsizing, whether it is because you are just now becoming an empty nester, or because you’re ready to move to a home that will be easier manage as you age and potentially experience some sort of mobility loss, I’m sure you have questions. You might even be feeling a little bit nervous. Perhaps you’re wondering whether or not you will have people to talk to and enough things to do in your new community. I’m here to say that one of the benefits of downsizing which you might not have recognized, is that you will likely appreciate the opportunity to rethink your location, your living space and your lifestyle. And as an added plus: acquire a useful influx of cash.

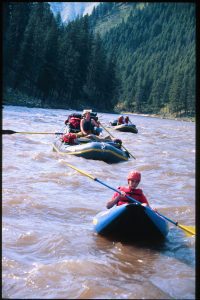

Kayaking can be a fun new hobby. The shells are lightweight and easy to carry, and paddling is note only good exercise, but the challenge is fun!

Many people who are downsizing because their kids are heading out on their own worry that having more ‘me time’ will bring its share of challenges! We experienced Boomers know that if you’re worried about not having enough to keep you busy, the best solution is to use your newfound time to develop a hobby or a new career.

This sort of fresh start also allows you to reevaluate your finances alongside the idea of moving to a new home and location. Downsizing not only ticks all these boxes, but it is also more feasible once your household size has shrunk.

A recent StorageCafe-sponsored study about downsizing which was shared with me recently by Michelle Aura, looked at how much money you can generate merely by downsizing from a 4-bedroom home to a 2-bedroom one. Nationally, the average gain is $196K, enough to put a couple of kids through college! Across the US, the figures vary of course, as do your new opportunities for employment and leisure.

Downsizing Allows You to Create the Home You Need Now…. AND You Can Work There, Too

When the kids first leave home, you might think that you want to keep their rooms ready for them to use when they come visit. But the fact is, they likely won’t visit for any length of time, so most of the time those old spaces just sit and collect dust, without any benefit to you. That’s another reason why I suggest you “seize the day” by moving to a smaller home. The kids can still come to visit, but they may have to sleep on a couch, share a room or possibly even stay in a nearby hotel or B&B. However, if you really want them to still maintain their own personal space in your new, smaller home, consider installing bunk beds in the second bedroom or possibly converting the attic!

Another thing to consider, which makes even better sense if you’re downsizing after the kids have left home, is to find out whether or not your employer offers you the option to work online. If that’s possible, why not consider moving to a new, smaller residence which is configured to allow working from home. As you probably know, ever since the advent of COVID almost three years ago, employers have become much more comfortable with home work. Which means you might be able to swing a deal where you can still work for your current employer — but do it from almost anywhere. And, since you now won’t have a commute, you might also find you can live without a car. So no need for a driveway or a garage, meaning your new home will require a small er financial investment. And all you need to do is set up a small office for yourself in a corner of your new home.

As downsizing offers you a fresh start, it’s smart to consider your future needs. Do you have parents or other elderly relatives who you’d like to have live with you? Even if it will just be you and your spouse in this new home, don’t fail to consider that you will be also be aging as you occupy this new space. The future you — or your older relatives — will appreciate a home that is handicap accessible, as this means you won’y have to retrofit later. So look for the presence of – or install now – handrails, non-slip flooring and extra lighting designed to help you in the years ahead.

Downsizing Can Net You a Fortune to Invest in Your Dreams

Now it’s time to think about your destination! Relocating within the same city means you won’t have to give up your friends, neighbors and activities. The nation’s priciest real estate can mean the most profitable downsizing. Moving to a home with two fewer bedrooms within New York’s Midtown neighborhood nets you an average of around $5.8M — consider investing that in the Manhattan restaurant you always wanted to open! — while the same type of move from there to Riverdale in the Bronx generates an average profit of $7.42M.

Downsizing within the same metropolitan area can also generate significant savings, and your old friends are still not so far away. Within California’s Bay Area, moving from San Francisco to Fremont gets you $1.4M on average, plus a more relaxed pace of life. In Washington State, downsizing from Seattle to family-friendly Tacoma would put an average of around $800K in your bank account, which is enough to buy a nearby home for those kids who just left! In Florida, moving from Fort Lauderdale to a smaller Miami home gets you an average of $570K — enough to buy a small yacht.

At the other end of the spectrum, away from the nation’s large coastal cities, you can still improve your finances and your lifestyle by moving to a smaller home. Dropping to a residence with two bedrooms fewer in the metropolitan areas centered on Rochester, New York, and Tucson, Arizona, for example, would net you an average savings of just under $100K. That money would be useful for redesigning your new residence exactly the way you always imagined your dream home ought to be.

Combine Downsizing With Self Storage to Maximize Your Living Space

If a reduction in living space cramps your lifestyle, consider self storage! Rather than letting your new home suffer from clutter, rent a storage unit nearby. Items you only use occasionally, such as tools, seasonal clothing, party paraphernalia and Christmas decorations, can be kept in a small 5’x10’ storage unit, for example. The cost of storage lockers is always much cheaper than the rent for residential space, and you can pick up your stuff whenever you need it.

As you are making a fresh start, now could be the time to try an exciting new hobby — this is especially relevant for us Boomers who are retiring after leading busy work lives. Golf clubs, skis, mountain bikes and even a small boat can be kept at a storage facility, and with your new-found wealth you could even join the trend for RV-ing and park a motorhome there. Budding artists can keep finished works — and materials — in a storage unit until you decide you’re ready to “go pro” and sell your work!

Whatever your personal circumstances, combining downsizing with aging in place or empty nesting will likely turn out to be one of the best decisions you will ever make. By moving to a new location, new horizons open up, and with the money generate, you can enjoy these new opportunities to the max. Plus, if you plan your new home layout well, the kids can still visit anytime. Bottom line: we feel sure you will quickly come to enjoy your new downsized life!

Leave a Reply

You must be logged in to post a comment.